According to Amazon, “retail media networks are a type of advertising platform that allows retailers to sell ad space on their digital channels to third-party brands.” This means that Retail Media Networks (RMNs) are digital ad businesses set up by retailers to monetize their online traffic and to offer their first-party data for targeted offsite advertising.

The consumer shift to ecommerce channels by nearly 30% has accelerated the sector’s expansion and challenged traditional retailers. Major players like Amazon, Walmart, and Target are capitalizing on this trend, making retail media a vital sector in digital advertising with a projected annual global growth rate exceeding 10% through 2026.

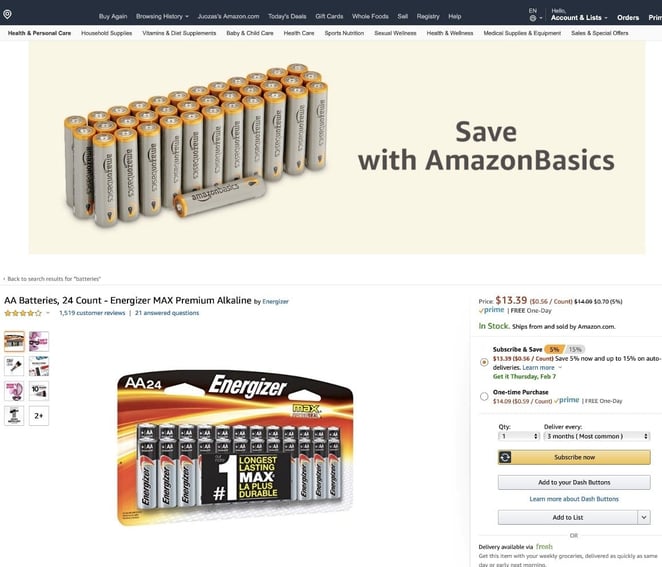

Amazon, a pioneer in this field since 2012, valued its advertising business at $37.7 billion globally in 2022. By 2026, Amazon is anticipated to claim a 13% share of the global digital advertising revenue. Copying Amazon’s playbook, Walmart and Target entered the retail media landscape in 2019, paving the way for more retailers and pharmaceutical companies to join in the upcoming years. So why the significant interest? In short, RMNs provide retailers and brands with the following opportunities:

- Additional revenue for retailers

- Improved retail footprint

- Closed-loop reporting and creative support

- Better shopping experiences for consumers

- Partnering with tech companies such as Google, Facebook & Criteo

For brands, especially those in the CPG industry, retail media networks provide various options to reach a large, targeted audience. That is why 73% of advertisers anticipate spending more on RMNs in the next 12 months, with RMNs capturing an estimated 10 to 15% of total media spend.

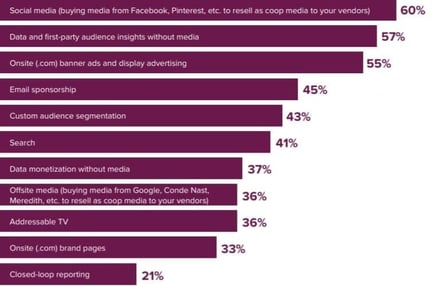

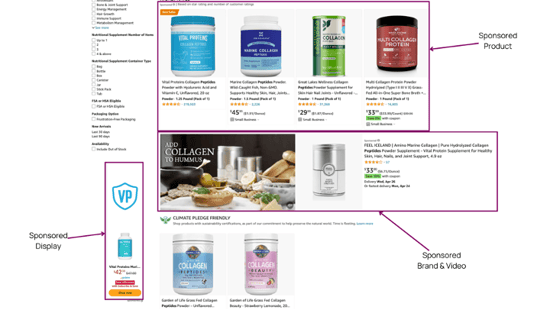

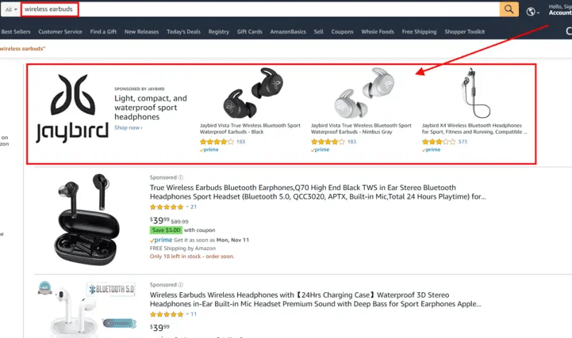

Retail Media Networks also enable brands to tap into the retailers' first-party data and track the return on ad spend (ROAS) to address the shoppers’ needs at each stage of the shopper journey and simultaneously measure their ads’ performance. Other vital capabilities RMNs offer to brands include:

Image Credit:

Image Credit:  Image Credit:

Image Credit:  Image Credit:

Image Credit: